dupage county sales tax calculator

Beginning May 2 2022 through. By entering the amount of the purchase price below you will be able to determine the applicable transfer taxes which may be charged.

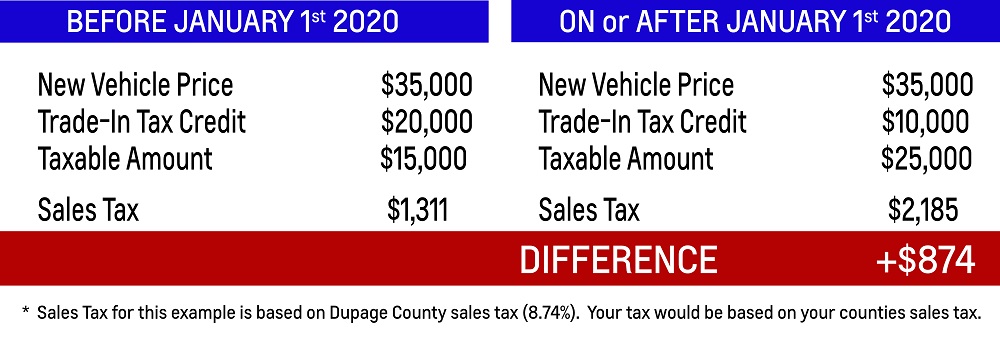

Dupage Sales Tax Reduction Makes Buying A Car Cheaper

The tax levies are adopted by each taxing districts board and.

. To calculate the sales tax on your vehicle find the total sales tax fee for the city. 05 lower than the maximum sales tax in IL. Our DuPage County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. The minimum is 725. To use the calculator just.

This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes. County Farm Road Wheaton IL 60187.

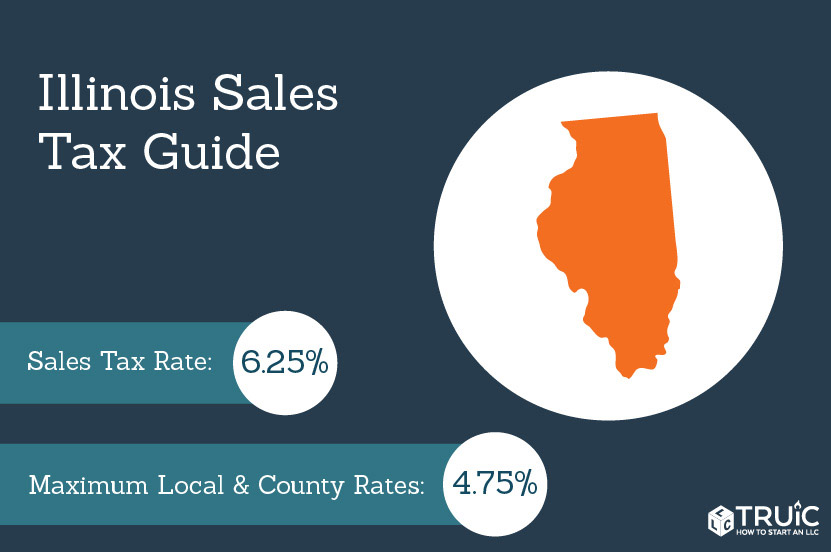

Studio - 3 Beds. The Illinois sales tax of 625 applies countywide. As a note the average successful interest rate bid at the Tax Sale held in.

Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. DuPage County IL Government Website with information about County Board officials Elected Officials 18th Judicial Circuit Court Information Property Tax Information and Departments. DuPage County Administration Building.

3668 Rentals Available in DuPage County. While many counties do levy a countywide sales tax Dupage County does not. DuPage County IL Government Website with information about County Board officials Elected Officials 18th Judicial Circuit Court Information Property Tax Information and Departments.

Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a. Some cities and local governments in Dupage County collect. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a.

The Illinois state sales tax rate is currently. Calculate how much your actual real estate tax. The base sales tax rate in DuPage County is 7 7 cents per 100.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Any property owner can question a property tax assessment. Puerto Rico has a 105 sales tax and Dupage County collects an.

It will continue until all delinquent parcels are sold. 121 N Cross St Wheaton IL 60187. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The December 2020 total local sales tax rate was also 7000. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due. Of this 50 cents of county-wide taxes are for County government use Sales tax is.

The base sales tax rate in DuPage County is 7 7 cents per 100. The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special. The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County.

But first look at what the appraisal actually does to your yearly property tax bill. Dupage county 5417 tax assessor. The 2021 annual real estate Tax Sale will begin on Thursday November 17 2022.

The current total local sales tax rate in DuPage County IL is 7000. Multiply the vehicle price before trade-in or incentives by the sales tax. The DuPage County Clerk can verify the interest rate on your sold parcel along with the total amount due.

Illinois has a 625 statewide sales tax rate but also. In addition to state and county tax the City of. Please select a payment.

If no registered tax buyer bids on a parcel DuPage County as Trustee for all DuPage County taxing bodies becomes the buyer at an interest rate of 18.

Wood Dale Taxpayers Give 2 7 Million In Non Home Rule Sales Tax In 2021 Dupage Policy Journal

Payroll Tax Deferral May Help Employees Affected By Covid 19 Kane County Business Law Attorneys

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Illinois Sales Tax Small Business Guide Truic

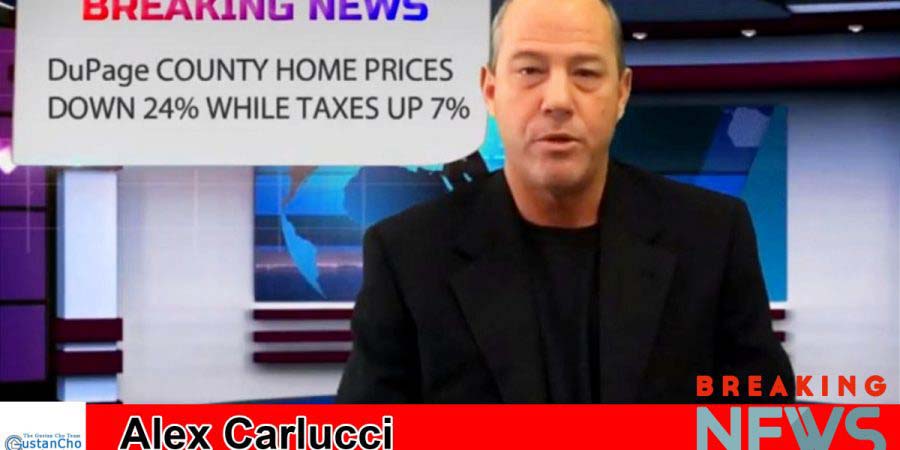

Dupage County Home Values Down 24 Property Tax Up 7

U S Cities With The Highest Property Taxes

New Illinois Tax Law Deery Brothers

How Real Property Taxes Are Calculated In Cook County Reda Ciprian Magnone Llc

Illinois Sales Tax Guide For Businesses

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

Property Tax Calculator Tax Rates Org

Oakbrook Terrace Residents Pay 2 6 Million In Municipal Sales Tax In 2021 Dupage Policy Journal

Cook County Tax Increase Chicago Tribune

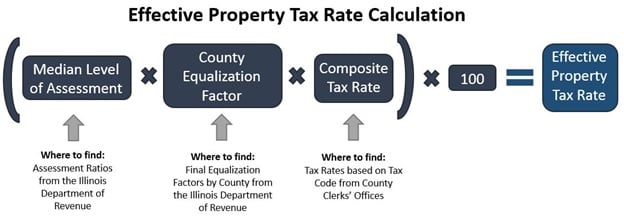

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Illinois Sales Tax Guide For Businesses

High Property Taxes In Illinois Real Estate Lawyer

North Central Illinois Economic Development Corporation Property Taxes

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates